Excerpted from the WSJ Editorial: “Their Fair Share”, July 21, 2008

“No President has ever plied more money from the rich than George W. Bush did with his 2003 tax cuts … The latest IRS data … show that the 2003 Bush tax cuts caused what may be the biggest increase in tax payments by the rich in American history.

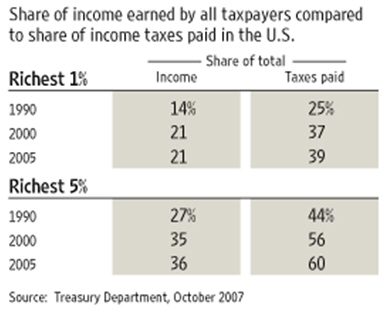

The top 1% of taxpayers, those who earn above $388,806, earned 22% of all reported income and paid 40% of all income taxes in 2006, the highest share in at least 40 years.

The top 10% in income, those earning more than $108,904, paid 71% [of all income taxes]..

Americans with an income below the median paid a record low 2.9% of all income taxes, while the top 50% paid 97.1%.”

The WSJ editors project: If tax rates are raised on the rich — the Obama plan — their share of tax payments will fall. The last time tax rates were as high as Obama wants them — the Carter years — the rich paid only 19% of all income taxes, half of the 40% share they pay today. Why? Because they either worked less, earned less, or they found ways to shelter income from taxes so it was never reported to the IRS as income.

For full editorial:

http://online.wsj.com/article/SB121659695380368965.html

* * * * *

Observations & Questions

1. This isn’t new news, but seems to get swept under the carpet — largely because of legitimate concern for the uneven distribution of earning power in the U.S.

2. What is if “fair share”? Who should decide what it is? On what basis? Ability to pay ???

3. What is the goal of the income tax system: “collect and spend”(on necessary gov’t services) or “take and redistribute”

4. Based on cocktail party conversations, the WSJ is certainly right on at least point: folks are already starting to think about tax strategies to cope with likely tax rate increases.

5. Warning: This editorial aroused my curiosity — so, several posts on the topic are on their way … with numbers, of course.

Want more from the Homa Files?

Click link => The Homa Files Blog

July 22, 2008 at 5:12 pm |

Seems to me that US Gov is determined to drive away the most sucessfull of their citizens to UK, Switzerland, or Carribian. In effect USA is charging way out of the market rates for the citizenship “product” and the best will just leave for a better value proposition. See below.

“Along with citizens of North Korea and a few other countries, Americans are taxed based on their citizenship, rather than where they live. So they usually pay twice—to their host country and the Internal Revenue Service”

http://www.economist.com/finance/displaystory.cfm?story_id=11554721

http://www.iht.com/articles/2006/12/17/news/expat.php

October 19, 2008 at 1:52 am |

For all its imperfections, a progressive tax system is still the best way forward. The singular objective being to collect more taxes from the rich than the poor. It’s solely because it makes the most sense. Now before dismissing it as distasteful socialism, welfare state blah, we have to bear in mind, as you mentioned, the “uneven distribution of wealth”. No matter how u cut it, in order to get more money into govt, the money will surely have to come more from the rich. No one likes taxes and I’m one of those foreigners stupid enough to remain in US paying this damned US taxes which as you said is already comparatively quite high and I’m not even in the 250k category. But the alternative is to tax businesses or implement a sales tax, which are also not exactly good solutions given the situation because it will tank the economy more. So in between a rock and a hard place, u still gotta make a choice.