More recently, I read in Dick Morris’ book Fleeced: “When Obama is done, the proportion of adult Americans who pay taxes at all will become a minority of our population” (p.41)

Finally, curiosity (and selfish interests) got the best of me and I decided to get some facts and crunch some numbers.

My conclusion: UH-OH !!!

Here are some things to mull over.

* * * * *

10% Bracket

The Bush tax plan introduced a 10% tax bracket that currently applies to individual tax filers with taxable incomes less than $7,825 Over $7,825 is taxed at the ‘old’ 15% marginal rate. For marrieds filing jointly, the 10% bracket goes up to $15,659.

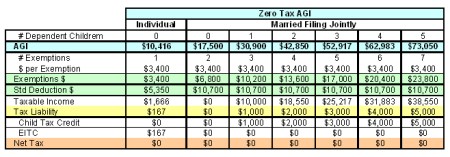

Technical note: Taxable income equals Adjusted Gross Income (AGI) less $3,400 per personal exemption (the filer plus dependents), less deductions. The standard deduction is $5,350 for individuals and $10,700 for married couples filing jointly.

* * * * *

Child Tax Credit (CTC)

Additionally, the Bush tax plan doubled the size of Child Tax Credit (CTC) from $500 per qualifying dependent child — the level introduced in 1997 — to $1,000; and made the credit “refundable” (i.e. a filer gets a check for any negative tax balance); and relaxed some of the limtations.

* * * * *

10% & CTC – So what?

Well, for example, a married couple — with 2 qualifying dependent children — filing a joint return — can report almost $43,000 in Adjusted Gross Income (AGI) and owe no taxes

Here’s how: The couple’s AGI of $42,850 gets reduced to a taxable income of $18,550 — $42,850 AGI less $13,600 in exemptions (4 times $3,400 per exemption), less the standard deduction of $10,700, equals $18,550. The tax on $18,550 is $2,000 — $1,565 plus 15% of the excess over $15,650 equals $2,000. But, the couple gets a $2,000 Child Tax Credit — $1,000 for each qualifying dependent child. So, the couple owes no taxes.

A married couple with 2 children who file jointly and report less than $42,850 get a refundable credit — a check from the government — in effect, a negative income tax.

* * * * *

Earned Income Tax Credit (EITC)

Similarly, the revised tax code provides for an Earned Income Tax Credit (EITC) based on a relatively complicated formula:

So what?

Well, for example, an individual with no child dependents can report up to $10,416 in AGI and owe no taxes. Those who report less than $10,416 in AGI, get a refundable credit. (Just trust me on the calculations — even if they’re not precise, I ‘m confident that they’re directionally right)

The table below displays the maximum AGI that individuals can report — and that maried couples can jointly report, depending on their number children — without owing income taxes i.e. their “zero-tax AGI)

* * * * *

Bottom 40% – Negative Income Taxes

Based on Congressional Budget Office (CBO) & Tax Foundation analyses of IRS data, the bottom 40% of tax filers — as a group — have negative tax liabilities.

That is, on average, the effective tax rates of the bottom 40% of filers are negative. So, the filers in these quintiles get a refundable credit paid by the government.

Technical note: These are averages ! Some filers in the group may pay some income taxes — but their tax liabilities are more than offset by filers with negative tax balances. And, as will be shown in a subsequent post, some filers in the middle quintile — which has a positive average effective rate — have negative tax liabilities.

Sources:

http://www.cbo.gov/ftpdocs/88xx/doc8885/12-11-HistoricalTaxRates.pdf

http://www.urban.org/UploadedPDF/1001091_distribution_federal_taxes.pdf

* * * * *

32% of filed returns – Zero (or Negative) Income Tax Liability

Of those in the bottom 40%, roughly 80% (i.e. over 32% of total filers) paid zero taxes or received a refundable credit.

* * * * *

41% of U.S. Population – Zero (or Negative) Income Tax Liability

Economists at the Tax Foundation estimate that — for the 2006 tax year — roughly 43.4 million tax returns, representing over 32% of the 136 million returns filed) and 91 million individuals, faced a zero or negative tax liability.

In addition to the 91 million, about 15 million low and no income households (averaging 2 people per household) are not required to file tax returns.

So, roughly 121 million Americans—or 41 percent of the U.S. population— pay no income tax, or — benefiting from the earned income tax credit or child credits — get a “refundable credit” back from the goverment (i.e. a check for “negative income tax”).

Source: Tax Foundation: “Number of Americans Outside the Income Tax System”

http://www.taxfoundation.org/research/show/542.html

* * * * *

59% Think Everyone Should Pay Something

Source: HarrisInteractive,

http://www.taxfoundation.org/files/topline-20050414.pdf

* * * * *

Next up: Will tax payers become a minority (of voting adults) any time soon? If so, so what?

* * * * *

Want more from the Homa Files?

Click link => The Homa Files Blog

July 29, 2008 at 5:10 pm |

Ken-

What is the AGI of the 41%st percentile of Americans by income?

Second, shouldn’t you exclude kids under the age of 18 (~20% of US population, roughly 60 million) from the analysis, since few of them are making any sort of significant income? I worked all through my teens but never made enough in a summer to exceed the standard deduction, so my taxes were always zero.

February 24, 2012 at 7:04 am |

[…] far back as July, 2008 we warned that under Obama: “Tax Payers Will Become a Dwindling Majority” To be fair, as the original post outlines, much of the credit (blame?) goes to Bush and the […]