In a prior post, I looked at the claim that Warren Buffett pays less taxes than his secretary:

(1) Based on numbers that WB throws around, his secretary pays about $18,000 in income taxes (to the Feds and state of Nebraska) … not much, but mostly due to the skimpy wages WB pays, not her reported 30% tax rate (Note: to get to 30%, you have to count Social Security taxes, Medicare taxes, Nebraska state taxes … and still do a hard round up)

(2) WB reportedly pays $8 million in taxes (on $46 million income) … obviously, $8 million is greater than $18,000 … but is only 17.7%

I hypothesized that his low rate was attributable to the favorable capital gains rate, but still wondered why WB wasn’t ripped by the Alternative Minimum Tax (the notorious AMT).

So, I dug a little deeper …

* * * * *

AMT Basics

The AMT was introduced in the late 1960s to snare ultra-high income folks who were using tax shelters and super-sized deductions to minimize their income tax liabilities — sometimes eliminating the liabilities entirely. All legal, but not what any objective person would deem fair.

Under the regular IRS rules, you start with your gross income and subtract deductions like mortgage interest, state & local taxes, charitable gifts, and exemptions for dependents. Eventually, you get to your taxable income, apply a tax rate ranging from 10% to 35% depending on your tax bracket, subtract any tax credits (e.g. Child Tax Credit) — and bingo — you have your tax liability.

Under AMT rules, you still start with your gross income, but immediately subtract an AMT “exemption amount” that usually starts in the ballpark of $50,000 and gets scaled back as income rises.

That sounds good to start, but since many of the usual deductions and exemptions (called “preference items”) are disallowed, your Alternative Minimum Taxable income may be a lot higher than your regular taxable income.

Some deductions are preserved, including those for mortgage-interest and charitable donations. But, some key breaks (i.e. the preference items) are disallowed. These include state and local income taxes and property taxes, personal exemptions, and the standard deduction (which over 60% of filers take).

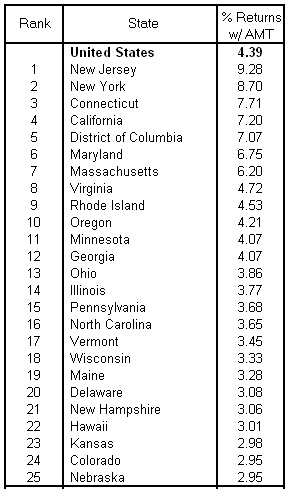

- State and local taxes are are the lion’s share of the disallowed preference items — almost 2/3’s — which is why high tax rate states (NJ, NY, CT, CA, DC, MS, MA — see table below) have the highest percentage of filers getting hit with the AMT.

- Fewer than 5% of tax filers — all high-earners, by definition — get hit by the AMT Yet it gets a lot of press attention. Why ? Ironically, the original law was crafted by Dems, but it’s folks in blue states (with high state taxes funding high state spending) that get hit most often with AMT.

The AMT tax rate runs from 20% to 28% — lower than the regular high-bracket 35% — but is applied to the higher Alternative Minimum Taxable Income. So, under AMT rules, you might end up paying more since you’re paying a lower rate on a greater amount of taxable income.

So, why isn’t Buffett paying a rate close to 28% on his $46 million income ?

Answer: we’re back to the preferential tax rate on capital gains.

* * * * *

AMT & Capital Gains

In a nutshell, Congress didn’t intend for the alternative minimum tax to apply to long-term capital gains. Why? I don’t know and can’t figure out …

And specifically, when Congress reduced the capital gain rates in 1997 and again in 2003, it provided that the lower rates would apply under the AMT, too.

In other words, long-term capital gains don’t get hit with the 28% AMT rate — they get the same preferential rate under the AMT as they do under the regular income tax — 15% for folks in the high brackets.

So, assuming that most of Buffetts’s income is long-term capital gains, it’s “sheltered” from the AMT and all he has to pay is 15% (on that portion of his income).

If all of Buffetts income was subject to the “regular” AMT rate, he’d be paying 28% — a higher federal rate than his secretary’s 15% federal income tax rate (see prior post for details). And, his tax bill would be almost $13 million, instead of a skimpy $8 million.

Case closed.

* * * * *

So What ?

1. Bumping the high-bracket marginal rate back up over 39% doesn’t fix the “Buffett Paradox”.

2. Increasing the capital gains rate just to “get” Buffett seems like committing the family to the asylum to avoid insulting your crazy uncle.

3. Seems like a quick patch to the AMT would fix the problem …

4. A broader — and more significant version of the Buffett Paradox, called “carried interest” — involves hedge funds and other private equity partnerships. That’ll be the subject of a subsequent post.

* * * * *

Good primers on the AMT:

http://money.cnn.com/2005/11/09/pf/taxes/amt_101/index.htm

http://www.fairmark.com/amt/amt101.htm

* * * * *

* * * * *

Want more from the Homa Files?

Click link => The Homa Files Blog

* * * * *

Leave a comment