Source: CNNMoney.com , Oct. 31, 2008

http://finance.yahoo.com/banking-budgeting/article/106069/Your-Money:-McCain-vs.-Obama#1

* * * * *

The best recap I’ve found — gives Obama some ‘benefits of doubt’, but is generally a factual and balanced presentation of the candidates’ positions. It’s long, but it’s required reading for responsible voters

* * * * *

Budget Deficit

Now that the government has committed over $1 trillion to stabilize the financial system and economic growth is expected to slow, the country’s growing deficits aren’t something the next president can ignore. Yet neither candidate has adequately addressed what changes he would make to accommodate the new fiscal reality. Both men speak of the need to restore fiscal responsibility while in the same breath promising more tax cuts and proposing spending cuts that are hard to achieve.

Obama

• Enforce budget rules that would require that new spending be paid for by cuts to other programs or new revenue.

• Reduce spending on earmarks to no greater than 2001 levels and require more transparency on such spending.

• Help pay for new proposals by drawing down troops in Iraq war, raising taxes on high-income filers and cutting certain corporate loopholes.

“Once we get through this economic crisis … we’re not going to be able to go back to our profligate ways. We’re going to have to embrace a culture and an ethic of responsibility, all of us, corporations, the federal government, and individuals out there who may be living beyond their means.”

McCain

• Originally pledged to balance budget by 2013. But McCain adviser now says it will take longer.

• Slow growth in Social Security, Medicare and Medicaid spending.

• Eliminate funds for pet projects, known as earmarks.

• Help pay for tax cuts by creating new jobs in the clean energy sector and developing new automotive technologies, which in turn will boost economic growth.

“Government spending has gone completely out of control; $10 trillion dollar debt we’re giving to our kids, a half-a-trillion dollars we owe China. I know how to save billions of dollars in defense spending. I know how to eliminate programs.”

* * * * *

Economic Crisis Response

Both candidates have proposed measures to help Americans cope with the economic downturn and stock market collapse. McCain’s proposals focus on helping seniors and investors. Obama wants to let savers tap into the retirement plans without early-withdrawal penalties.

Obama

• Temporarily allow penalty-free early withdrawals from IRAs and 401(k)s of up to 15% of the balance but not more than $10,000.

• Temporarily suspend rule that seniors age 70 1/2 take required annual distribution from retirement account.

• Give temporary tax credit of $3,000 in 2009 and 2010 to companies for each new full-time employee it hires in the United States.

• Temporarily eliminate taxes on unemployment benefits.

• Require financial institutions participating in bailout to put a 90-day moratorium on foreclosures for homeowners “acting in good faith.”

• Let federal government lend to state and municipal governments to help counter the budget crunch faced by states due to the mortgage crisis.

“We must move forward, quickly and aggressively, with a middle-class rescue plan that will create jobs, provide relief to families, help homeowners and restore our financial system.”

McCain

• Temporarily suspend rule that seniors age 70 1/2 take required annual distribution from retirement account.

• Tax withdrawals of up to $50,000 from IRAs and 401(k)s at 10% in 2008 and 2009.

• Reduce capital gains tax to 7.5% from 15% for two years.

• Increase amount of capital losses that may be used to offset ordinary income to $15,000 from $3,000 for 2008 and 2009.

• Temporarily eliminate taxes on unemployment benefits.

• Buy bad mortgages and renegotiate loan terms based on current value of home.

• Convert failing mortgages into low-interest, FHA-insured loans.

“…I will help to create jobs for Americans in the most effective way a president can do this — with tax cuts that are directed specifically to create jobs, and protect your life savings.”

* * * * *

Wall Street

In the wake of the credit crisis, both candidates have stressed the need for greater transparency and imposing capital requirements on financial institutions.

Obama

• Impose liquidity and capital requirements on investment banks.

• Streamline regulatory framework of the financial services sector.

• Create an oversight commission that would advise the president, Congress and regulators on the health of and risks facing financial markets.

• Give Federal Reserve supervisory power over any bank that borrows from it.

“Let me be clear: the American economy does not stand still, and neither should the rules that govern it. The evolution of industries often warrants regulatory reform…”

McCain

• Increase capital requirements on financial institutions.

• Remove some of the regulatory, accounting and tax impediments to raising capital.

• Examine how banks and other firms value assets that exacerbated the credit crunch.

• Increase transparency of complex financial instruments.

“Capital markets work best when there is both accountability and transparency. In the case of our current [credit] crisis, both were lacking.”

* * * * *

Mortgage Giant Rescue

Both candidates supported the federal government takeover of the mortgage insurance giants since they’re central to the housing market.

Obama

• Wants to void any inappropriate windfall payments to outgoing CEOs and senior management.

• Says shareholders should not benefit in takeover.

• Had said companies should either operate as goverment agencies or as private businesses.

“I recognize that intervention is necessary to maintain liquidity for the housing market so that homeowners can continue to get affordable mortgages and homes can be bought and sold in neighborhoods across the country.”

McCain

• Called for reform of corruption at Fannie Mae and Freddie Mac two years ago.

• Wants to clarify and unify regulatory authority of financial institutions, including the mortgage insurers.

“These quasi-public corporations lead our housing system down a path where quick profit was placed before sound finance…And now, as ever, the American taxpayers are left to pay the price for Washington’s failure.

* * * * *

Mortgage Fraud

Both candidates say they want to go after predatory lenders. Obama introduced the STOP FRAUD Act in the Senate and now it’s a part of his platform. McCain called for creating a task force to investigate criminal wrongdoing in the mortgage lending and securitization industry.

Obama

• Boost funding for law enforcement programs aimed at housing fraud by $40 million.

• Establish new federal criminal penalties for mortgage professionals found guilty of fraud.

• Require lending professionals to report suspicious or fraudulent activity.

• Establish a database of censured or debarred mortgage professionals, so borrowers can easily check the credentials of lenders.

• Establish a standardized estimate of the total annualized cost of a mortgage loan to make it easier for borrowers to compare different loans.

“We must establish stiff penalties to deter fraud and protect consumers against abusive lending practices.”

McCain

• Create a Justice Department task force that punishes individuals or firms that defrauded innocent homeowners or forged loan application documents.

• Task force would also assist state attorneys general investigating abusive lending practices.

• Improve transparency in the lending process so that borrowers know exactly what they are agreeing to.

“Lenders who initiate loans should be held accountable for the quality and performance of those loans and strict standards should be required in the lending process.”

* * * * *

Jobs and Wages

McCain’s plan for turning around the economy focuses on corporate tax policy, while Obama would take a more activist role that includes increasing wages and spending on public works.

Obama

• Fund federal workforce training programs and direct these programs to incorporate “green” technologies training.

• Raise minimum wage to $9.50 an hour by 2011 and tie future rises to inflation.

• Double federal funding for basic research and make R&D tax credit permanent.

• Set up $60 billion infrastructure investment bank to help fund public works. Also, create a $25 billion emergency Jobs and Growth Fund to fund other infrastructure projects.

• Establish tax credit for companies that maintain or increase the number of full-time workers in America relative to those outside the U.S.

• Give a temporary tax credit of $3,000 in 2009 and 2010 to companies for each new full-time employee it hires in the United States.

• Temporarily eliminate taxes on unemployment benefits.

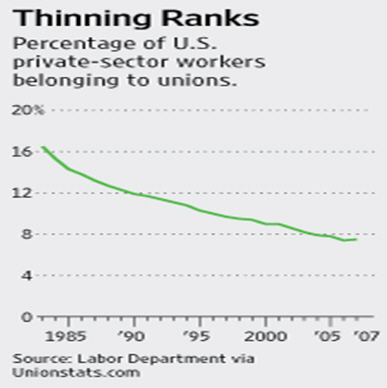

• Advocate for stronger unionization.

“We will provide incentives to businesses and consumers to save energy and make buildings more efficient. That’s how we’re going to create jobs that pay well and can’t be outsourced.”

McCain

• Spur economy and job growth by cutting corporate tax rate and temporarily lowering current rates on dividends and capital gains.

• Leave minimum wage at $7.25 an hour, which is where current law will take it to by 2009. Opposed to tying future hikes to inflation rate.

• Create tax credit equal to 10% of wages spent on R&D.

• Consolidate federal unemployment programs and reform training programs for job seekers.

• Temporarily eliminate taxes on unemployment benefits.

“We will build a new system, using the unemployment-insurance taxes to build for each worker a buffer account against a sudden loss of income — so that in times of need they’re not just told to fill out forms and take a number.”

* * * * *

Savings

Obama wants the government to augment low- and middle-income workers’ savings. McCain would help retirees keep their savings.

Obama

• Require employers that don’t offer retirement plans to set up IRA-type accounts.

• Require companies to automatically enroll their employees in 401(k)s or IRAs.

• Provide a federally funded match on retirement savings for families earning below $75,000.

• Temporarily suspend mandatory withdrawals from retirements accounts for senior citizens age 70 1/2 and older.

“Personal saving is at an all-time low. A part of the American dream is at risk.”

McCain

• Require companies to automatically enroll their employees in retirement plans they offer.

• Encourage saving by keeping investment taxes low.

• Temporarily suspend mandatory withdrawals from retirements accounts for senior citizens age 70 1/2 and older.

“As president, I intend to act quickly and decisively to promote growth and opportunity. I intend to keep the current low income and investment tax rates.”

* * * * *

Driving

Both candidates want to make every gallon count. Government prizes are pivotal to McCain’s plan, while Obama wants to place more stringent requirements on automakers.

Obama

• Double fuel economy standards within 18 years while maintaining current flexibility.

• Offer $7,000 tax credit to buyers of plug-in hybrids.

• Mandate all new cars be flex-fuel capable.

• Provide $4 billion in retooling credits and loans to help domestic manufacturers switch to more fuel-efficient cars.

• Aim to get 1 million 150 mile-per-gallon plug-in hybrids on the roads within six years.

• Support creation of more transit-friendly communities and level employer commuting assistance for driving and public transit.

“I have a plan to raise the fuel standards in our cars and trucks with technology we have on the shelf today — technology that will make sure we get more miles to the gallon.”

McCain

• Raise penalties car companies pay for violating Corporate Average Fuel Economy (CAFE) standards.

• Offer $5,000 tax credit for every customer who buys a zero-emission car.

• Speed introduction of “flex-fuel vehicles” that can run on ethanol blends and gasoline.

• Remove or reduce tariffs on imported ethanol.

• Award $300 million prize to the company that can produce a plug-in hybrid battery technology at 30% of current costs, allowing commercial development of plug-in hybrid cars.

“…Our government has thrown around enough money subsidizing special interests and excusing failure. From now on, we will encourage heroic efforts in engineering, and we will reward the greatest success.”

* * * * *

Gas Prices

The candidates agree that consumers need help with sky-high fuel bills, but they have different plans for offering relief.

Obama

• Keep gas tax in place.

• Keep ethanol tariff to protect domestic industry.

• Tax oil profits and use the money to help fund $1,000 rebate checks for consumers hit by high energy costs.

• Eliminate oil and gas loopholes.

“I realize that gimmicks like the gas tax holiday and offshore drilling might poll well these days. But I’m not running for president to do what polls well…”

McCain

• Repeal the 54-cents-a-gallon tariff on imported ethanol.

• Eliminate a current tax break for oil companies, but lower corporate taxes across the board.

“The effect [of a gas tax holiday] will be an immediate economic stimulus — taking a few dollars off the price of a tank of gas every time a family, a farmer, or trucker stops to fill up.”

* * * * *

Fighting Foreclosure

Obama wants the government to step in to help homeowners facing foreclosure. McCain unveiled rescue plan in October debate.

Obama

• Allow troubled homeowners to refinance to a loan insured by the Federal Housing Administration.

• Require any financial institution participating in Treasury’s Troubled Asset Relief Program to put a 90-day moratorium on foreclosures for homeowners “acting in good faith.”

• Create a 10% tax credit for homeowners who do not itemize their taxes.

• Create a $10 billion fund to help victims of predatory loans.

• Create a separate $10 billion fund to help state and local governments maintain critical infrastructure.

• Authorize bankruptcy judges to reduce mortgage principal.

“…If the government can bail out investment banks on Wall Street, then we can extend a hand to folks who are struggling on Main Street.”

McCain

• Buy bad mortgages and renegotiate loan terms based on current value of home. Convert failing mortgages into low-interest, FHA-insured loans.

• Offer of financial assistance to borrowers contingent upon lending reform.

• Provide more funding for community development groups so they can expand their home rescue efforts.

“The United States government will support the refinancing of distressed mortgages for homeowners and replace them with manageable mortgages.”

* * * * *

Personal Taxes

Both candidates favor keeping some or all of the Bush tax cuts in place. Wealthy taxpayers win out under McCain’s plan, while lower-income earners benefit more under Obama’s proposals.

Obama

• Leave all tax cuts in place for everyone except couples making more than $250,000 and single filers making more than $200,000. Those high-income groups would see their top two income tax rates revert to 36% and 39.6% from 33% and 35% respectively.

• Provide $1,000 tax cut for working couples making less than $250,000.

• Introduce other tax breaks for lower and middle-income households.

“We shouldn’t be distorting our tax code to benefit a few powerful interests — we should be insisting that everyone pays their fair share, and when I’m president, they will.”

McCain

• Make 2001 and 2003 tax cuts permanent for everyone.

• Permanently repeal the Alternative Minimum Tax, the so-called “wealth tax” that threatens the middle class.

“I will…propose…a middle-class tax cut — a phase-out of the Alternative Minimum Tax to save more than 25 million middle-class families as much as $2,000 in a single year.”

* * * * *

Taxing Wealth

McCain would apply a lighter hand to taxes paid by the wealthy than would Obama, who wants to make the tax code more progressive.

Obama

• Tax carried interest as ordinary income rather than as an investment gain, thereby subjecting it to much higher tax rates than 15%.

• Freeze the exemption amount of estates free from the estate tax at $3.5 million — where it will be in 2009.

• Freeze top estate tax rate at 45%.

• Raise capital gains and dividend tax rates to 20% from 15% for couples making more than $250,000 and singles making more than $200,000.

“We’ve lost the balance between work and wealth. I will close the carried interest loophole, and adjust the top dividends and capital gains rate…”

McCain

• Preserve the 15% tax rate on carried interest – the cut that private equity and hedge fund managers take when the funds they manage make a profit.

• Increase the amount of money exempt from the estate tax to $5 million.

• Reduce the top estate tax rate to 15% from 55% – where it otherwise will be in 2011 under current law.

• Reduce long-term capital gains rate to 7.5% for 2009 and 2010. Keep short-term capital gains and dividend tax rates where they are.

• Increase the amount of capital losses which can be used in tax years 2008 and 2009 to offset ordinary income from $3,000 to $15,000.

“Sharply raising taxes on investment is a step in the wrong direction for the competitiveness of U.S. capital markets.”

* * * * *

Taxing Business

McCain is generally considered to be more friendly to Corporate America than is Obama, who wants to increase some companies’ tax bite in a few ways.

Obama

• Consider reducing the corporate tax rate in conjunction with closing corporate tax loopholes.

• Make R&D credit permanent.

• Impose windfall profits tax on oil and gas companies.

• Exempt investors from the capital gains tax on their investments in small businesses and startups if they made their investment when a small company was valued below a certain threshold. That threshold has yet to be defined.

• Make renewable production credit permanent.

• Require companies to verify transactions that have benefits other than their tax benefits.

“…We can’t just focus on preserving existing industries. We have to be in the business of encouraging new ones — and that means science, research and technology.”

McCain

• Reduce corporate tax rate to 25% from 35%.

• Make R&D credit permanent, but change formula.

• Repeal several oil company tax breaks.

• Accelerate business expense deductions.

• Broaden corporate base.

“Serious reform is needed to help American companies compete in international markets. I have proposed a reduction in the corporate tax rate from the second highest in the world to one on par with our trading partners.”

* * * * *

Small Business

While both candidates promise to help entrepreneurs with friendly tax policies, they differ sharply on how much of the tab for employees’ health insurance and other benefits they expect fledgling businesses to pick up.

Obama

• Expand the SBA’s direct-lending Disaster Loan Program to extend loans to companies affected by the economic downturn and credit crunch.

• Temporarily eliminate fees and increase the amount guaranteed by the government through the SBA’s 7(a) and 504 programs, which insure lenders against defaults on small business loans.

• Extend the stimulus act’s Section 179 tax deduction, which increased the amount businesses can write off on their taxes for capital investments in new equipment, through 2009.

• Exempt investors from the capital gains tax on their investments in small businesses and startups if they made their investment when a small company was valued below a certain threshold. That threshold has yet to be defined.

• Offer a 50% refundable credit for employee health insurance premiums paid by the employer.

• Freeze estate tax rate at 45% and increase exemption to $3.5 million.

“We’ll work, at every juncture, to remove bureaucratic barriers for small and startup businesses.”

McCain

• Allow small businesses first-year expensing of new equipment and technology purchases.

• Establish a permanent tax credit equal to 10% of what a business spends on wages for research and development.

• Issue tax credits to allow individuals to purchase personal, portable health insurance that can move with them from job to job.

• Reduce the corporate income tax rate to 25% from 35%.

• Cut estate tax rate to 15% and increase exemption to $5 million.

“…I will pursue tax reform that supports the wage-earners and job creators who make this economy run, and help them to succeed in a global economy.”

* * * * *

Free Trade

Both McCain and Obama say they are in favor of free trade. McCain has been a stronger defender of free trade agreements, while Obama has been a more vocal critic.

Obama

• Work to renegotiate NAFTA, the free trade agreement with Canada and Mexico.

• Opposes the free trade agreements with South Korea and Colombia.

• Use trade agreements to spread good labor and environmental standards around the world.

• Supports steep tariffs on imports from China if the Chinese keep their currency from rising.

• Increase and expand assistance offered to workers who lose jobs due to trade and create flexible education accounts to help workers retrain.

“Allowing subsidized and unfairly traded products to flood our markets is not free trade and it’s not fair. We cannot let foreign regulatory policies exclude American products. We cannot let enforcement of existing trade agreements take a backseat to the negotiation of new ones.”

McCain

• Back additional trade agreements and engage in multilateral, regional and bilateral efforts to reduce barriers to trade.

• Supports the free trade agreements negotiated with South Korea and Colombia which are now awaiting Senate approval.

• Would not threaten to impose tariffs on Chinese imports here if China does not allow the value of its currency, the yuan, to rise against the dollar.

• Improve efforts to provide retraining for those who lose their jobs due to imports.

“If I am elected president, this country will honor its international agreements, including NAFTA, and we will expect the same of others. And in a time of uncertainty for American workers, we will not undo the gains of years in trade agreements now awaiting final approval.”

* * * **

Energy Security

The candidates agree on the need to reduce dependence on foreign oil and cut greenhouse gases. Both support a carbon “cap-and-trade” system where companies either pay to pollute or invest in cleaner technology.

Obama

• Work to reduce carbon emissions 80% below 1990 levels by 2050.

• Invest $150 billion in renewable energy over the next 10 years.

• Allow limited amount of offshore drilling.

• Require that 10% of nation’s energy comes from renewable sources by 2013.

• Aim to reduce nation’s demand for electricity 15% by 2020.

“To bring about real change, we’re going to have to make long-term investments in clean energy and energy efficiency.”

McCain

• Work to reduce carbon emissions 60% below 1990 levels by 2050.

• Use mix of free market, government incentives and a lower corporate tax rate to foster renewable energy.

• Lift ban on offshore drilling.

• Commit $2 billion annually to advance clean coal technologies.

• Construct 45 new reactors by 2030 as part of a push to expand nuclear power production.

“…When it comes to energy, what we really need is to produce more, use less, and find new sources of power.”

* * * * *

Health Care

McCain would rely most heavily on individuals and the free market to lower costs, while Obama would rely more on government and mandates to make coverage affordable.

Obama

• Coverage would be mandatory for children.

• Offer an income-based federal subsidy for people who don’t get insurance from an employer or qualify for government plans like Medicaid.

• Create a national network of public and private plans for those without other access to insurance.

• Require employers to either offer a plan, help pay for employee costs or pay into a national health care network.

“…We need to pass a plan that lowers every family’s premiums, and gives every uninsured American the same kind of coverage that members of Congress give themselves.”

McCain

• Coverage would not be mandatory for anyone.

• Change how health care subsidies are taxed.

• Offer refundable tax credit for anyone who buys health insurance.

• Create a federally subsidized state-administered program to offer coverage for low-income people.

“I’ve made it very clear that what I want is for families to make decisions about their health care, not government…”

* * * * *

Medicare

Rising health care costs are pushing Medicare toward an unsustainable long-term deficit nearly 5 times that of Social Security. Both candidates say their efforts to reduce health care costs will help stabilize Medicare. What few Medicare proposals they’ve made aren’t sufficient to address the shortfall, health care experts say.

Obama

• Would let government negotiate for Part D drug prices.

• Would increase use of generic drugs in Medicare.

• Wants to close the coverage gap known as the “doughnut” hole in Part D for reimbursement of prescription drugs.

• Favors eliminating subsidies paid to private Medicare Advantage plans.

• Wants to legalize importation of some prescription drugs.

“As president, I will reduce costs in the Medicare program by enacting reforms to lower the price of prescription drugs, ending the subsidies for private insurers in the Medicare Advantage program and focusing resources on prevention and effective chronic disease management.”

McCain

• Wants wealthy people who are enrolled in the Part D drug coverage program to pay more.

• Wants to reform the payment system so health care providers don’t get paid when medical errors or mismanagement occurs.

• Favors importing low-cost prescription drugs from Canada.

“People like Bill Gates and Warren Buffett don’t need their prescriptions underwritten by taxpayers. Those who can afford to buy their own prescription drugs should be expected to do so.”

* * * * *

Social Security

To help shore up the system, McCain favors individual accounts and reducing benefit growth. Obama prefers to raise taxes.

Obama

• Opposes individual investment accounts.

• Against raising retirement age.

• Favors increasing the amount that workers making $250,000 or more pay into the system. Considering plan to tax income over $250,000 at between 2% and 4% – half of which would be paid for by the employee and half by the employer.

“We will not privatize Social Security, we will not raise the retirement age, and we will save Social Security for future generations by asking the wealthiest Americans to pay their fair share.”

McCain

• Supplement Social Security benefits with individual investment accounts.

• Prefers slowing the growth in benefits to raising taxes.

“…You have to go to the American people and say…we won’t raise your taxes. We need personal savings accounts, but we [have] got to fix this system.”

* * * * *

Bankruptcy

Obama wants to reform the bankruptcy process and has proposed changes to help those in financial distress. As a Senator, McCain voted in favor of legislation aimed at curbing the growing number of bankruptcy filings.

Obama

• Fast-track bankruptcy process for military families.

• Help seniors facing bankruptcy keep their home.

• Put pension promises higher on list of debts a bankrupt employer must pay.

• Amend bankruptcy laws to protect people trapped in predatory home loans.

“I fought against a bankruptcy reform bill in the Senate that did more to protect credit card companies and banks than to help working people. I’ll continue the fight for good bankruptcy laws as President.”

McCain

• Backed 2005 legislation that imposed new costs on those seeking bankruptcy protection.

The law, which Obama opposed, passed the Senate with Democratic support in 2005.

* * * * *

Want more from the Homa Files?

Click link => The Homa Files Blog

SHARE THIS POST WITH FRIENDS & FAMILY