The stock market soared yesterday because…

==============

First, the numbers…

Yesterday, the stock market soared … the S&P was up 5.54% to 3,956.

Let’s put that number in perspective…

The S&P at 3,956 is:

- 3% higher than when Biden was inaugurated (01/20/21 S&P = 3,841)

- 17% lower than the sugar-high market peak (12/27/21 S&P = 4,766)

- 11% higher than the Biden era market trough (10/12/22 S&P = 3,577)

To summarize, the market today is about where it was when Biden was inaugurated … has recovered about 1/3 of the 25% peak to trough decline … and is up 11% from the trough.

So, you can either feel bad (still down 17% from the peak) … or good (recovered about 1/3 of the peak to trough decline).

=============

For today, let’s focus on the positive … yesterday’s bounce … and ask “why?”

There were 2 near-simultaneous events yesterday morning.

- The reported inflation rate for October was down to 7.7%

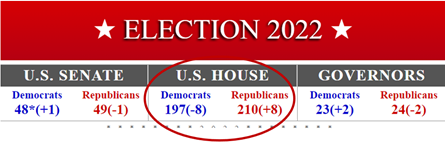

- Media vote counting arbiters conceded that the GOP was on track to gain control of the Congress.

My take:

The 7.7% is statistically insignificant from the recent inflation running rate … it’s likely month-to-month noise … and likely driven by a decline in residential housing prices … which is, perhaps, a blessing for renters, but a curse to homeowners (whose home is a big chunk of their net worth).

So, I don’t place much weight on the 7.7% inflation rate driving the market gain.

=============

I think the market gain was driven by the near certainty that the GOP will control Congress and we’ll have split government gridlock for the next 2 years … and, at least, an end to reckless government spending.

Here’s hoping…