And, he rushed to tell me before the mid-term elections.

===============

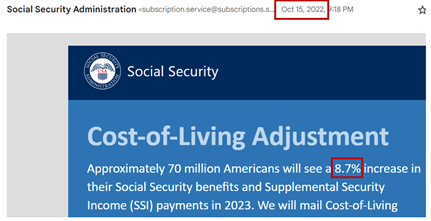

Here’s an email that I got from the Social Security Administration on Oct.15:

A couple of takeaways from the email…

- The 8.7% COLA (cost of living increase) is the Fed government’s inflation estimate … required to keep SS recipients whole 2023.

- The notice was sent to Social Security recipients on October 15.

What’s interesting about the date?

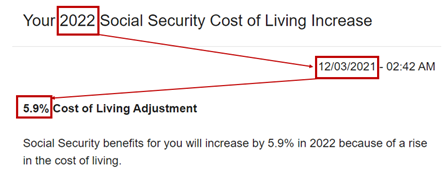

> Last year, we SS recipients were notified of the 2022 cost-of-living increase (5.9%) on December 3, 2021.

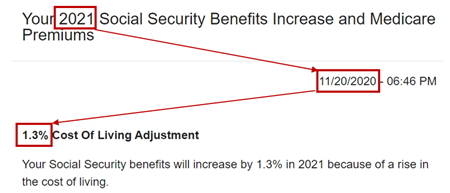

> Two years ago, we SS recipients were notified of the 2021 cost-of-living increase (1.3%) on November 3, 2020.

Let’s recap …

> Based on Trump’s last year in office (2020), the inflation-based COL increase for 2021 was 1.7%

> Based on Biden’s first year in office (2021), the inflation-based COL increase for 2022 was 5.9%

> Based on Biden’s 2nd year in office (2022 YTD), the inflation- based COL increase for 2023 is 8.7%.

Ouch.

But, that’s not really new news, right?

What’s more interesting (to me) is the timing of the announcements.

The past years’ practice had been to notify SS recipients of their COLA adjustments (for the next year) in late November or early December.

This year the COLA notification was sent on October 15 … a couple of weeks before the mid-terms.

Coincidence?

Call me skeptical.

I can just envision Biden screaming:

“I protected your Social Security benefits against inflation … and, the Republicans want to take them away.”

That’ll be me screaming when he reads the words from the teleprompter …

==============

We’ve gotta take a told-ya-so lap on this one…

We alerted loyal readers to this probable Biden scam way back on Oct 17, 2022 at 06:45am

Yes, that was me screaming Wed. night…