Archive for the ‘Economy’ Category

July 26, 2022

Team Biden’s PR stunt reimagining what a recession is, in Biden-speak, pure malarkey.

=================

Team Biden’s crack team of political-economists is apparently trying to front-run this weeks GDP release by moving the goal posts.

Not by a couple of feet … or to the stadium parking lot … but to another stadium.

They’re saying “A recession is not fairly defined by a 2-quarter drop in GDP. It needs to be evaluated holistically, after all related data is available and analyzed. And, that takes time. Maybe a year or so after the GDP decline.”

That’s partially true.

The NBER — the “official” recession sanctioning body — does consider multiple factors (i.e. more than simply a 2-quarter drop in GDP) when declaring that a recession has occurred.

But, here’s an acid test question that cuts to the crux of the matter:

Out of the past 10 times the U.S. economy has experienced two consecutive quarters of negative economic growth, how many times was a recession officially declared (holistically after-the fact) by the NBER?

Answer: All 10 times !

Source: AEI

Said differently, post-WWII – a 2-quarter drop in GDP has been a perfect indicator of a recession.

In that time period, the NBER has always “holistically” confirmed a recession after a 2-quarter drop in GDP

Nonetheless, Team Biden would advise:

Don’t generalize from your personal experience …and certainly don’t rely on the data … trust us Team Biden economists when we say that everything is fine & dandy.

These guys have no conscience.

=============

P.S. The pundit consensus seems to be that Team Biden’s front-running “reimagination” is an attempt to defuse the impact of of a bad GDP number.

Obviously, they already know what the “top secret” number is.

Wouldn’t surprise me if the reported number is an infinitesimal increase in GDP.

That would give Biden a chance to boldly proclaim: “See, I told you that we’re not in a recession. The economy is strong.”

Naw, they’re not that smart…

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Bidenomics, Economics, Economy, Recession | 1 Comment »

May 12, 2021

And, apparently I’m not alone.

=============

Team Biden says not to worry, their lucrative pay-to-not-play poli-finance money-printing isn’t impacting the labor market or inflation.

Bull-dinky!

I just got 2 shocks that suggest the contrary.

We’re in the process or re-siding part of our house — just replacing some badly weathered boards.

The carpenter warned me that lumber prices were thru the roof.

Today, he handed me the bill. A small load of cedar siding cost me $3,700 — just for the materials.

The carpenter said that a couple of months ago, it would have cost $1,200.

That’s completely consistent with news reports of a tripling in lumber prices due homebuilding demand and supply shortages. Source

=============

More broadly, the BLS reported today that the CPI is up 4.2% year-over-year … the sharpest YOY rise in over a decade … you know, back in the Obama-Biden years. Is history repeating?

Note: “Energy Commodities“ prices were up almost 49% … and that’s before a CNN prediction that “Coming this summer: Gas stations will be running out of gas.”

Ouch.

=============

I always liked to ask my Trump-hating friends which they were most opposed to: the peace or the prosperity?

With prices soaring and former workers reinventing themselves as government-funded couch potatoes … and the Middle East literally exploding … we now have both less prosperity and less peace.

Maybe the Trump-haters think that’s a small price to pay for fewer mean tweets.

=============

P.S. And, I haven’t even mentioned the southern border … or faux school openings.

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Biden, Joe, Economy, Trump, Donald | Leave a Comment »

January 7, 2019

The economy has been el fuego since Trump took office.

================

Last Friday’s jobs report was – by all measures – a blowout.

An exclamation point that the economy – save for the stock market – had a remarkable year.

The headline: 312,000 jobs added in December.

That’s more than the 176,000 that economists expected … and brought the 2018 total number of new jobs to more than 2.6 million.

Drilling down, the numbers are even more impressive …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Trump, President Donald J. | Leave a Comment »

February 15, 2018

One of the benefits of the current low unemployment rate is that many people who were previously working part-time “for economic reasons” (i.e. had their hours reduced to part-time status or couldn’t find a full-time job) are now employed full-time.

By the numbers …

Approximately 127 million workers are now employed full-time …. that’s an all-time high … up 16 million from the financial crisis low point … and up 5 million from the pre-crisis high.

Here’s the interesting part …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economic indicators, Economy, Employment - Jobs, Health Care / Medical Insurance | Leave a Comment »

December 8, 2016

“A permanent job with good benefits is (now) beyond reach for most American workers … only federal judges and tenured professors are insulated from the forces of workforce transformation”

That’s according to the authors of the book Working Scared (Or Not at All): The Lost Decade, Great Recession, and Restoring the Shattered American Dream

======

The book Working Scared is focused on the ways that the American workplace has changed in the past 50 or so years … and the implications on American workers (and non-workers).

=======

The central premise of the book is that globalization (out-sourcing & off-shoring); de-industrialization (towards more services and knowledge-based); technology-intensity (computers, internet, robots); and de-unionization have shattered the American Dream for tens of millions of working adults who are struggling or poor … “despite working hard and playing by the rules.”

More specifically …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Employee engagement, Jobs - Unemployment, Working Scared | 1 Comment »

December 5, 2016

More able-bodied men are sitting on their duffs …

========

The November jobs report in a nutshell: 160k jobs added, but … the adult population increased by 219k and the civilian labor force contracted by 226k … so, the labor force participation rate dropped again.

It’s no secret that the Labor Force Participation — the % of able bodied adults who are employed or looking for work — has dropped about 4-1/2 percentage points from pre-financial crisis levels … and continues to fall.

=======

The economy-is-doing-just-fine crowd chalks the declining rate to demographics – old-timers retiring.

In prior posts I’ve attributed about 1/3 to retirees … the rest to slackers.

To that point, let’s cut the data a different way …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Employment - Jobs | 3 Comments »

November 13, 2016

Forget ‘Labor Force Participation Rate’ … here’s the indicator to watch

========

It’s no secret that the Labor Force Participation — the % of able bodied adults who are employed or looking for work — has dropped about 4-1/2 percentage points .

=======

The economy-is-doing-just-fine crowd chalks the declining rate to demographics – old-timers retiring.

In prior posts I’ve attributed about 1/3 to retirees … the rest to slackers.

To that point, let’s cut the data a different way …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Employment - Jobs | Leave a Comment »

November 11, 2016

Trump’s target constituency was identified by 2 liberal academics … who laid out the case, but drew the wrong conclusion.

======

Bottom line: Roughly 75% of the U.S. labor force (i.e. 100 million people) have been personally affected by or deeply concerned about joblessness:

Originally posted on May 15, 2016 titled “What do tenured profs & Federal judges have in common?“

=======

A permanent job with good benefits is (now) beyond reach for most American workers … only federal judges and tenured professors are insulated from the forces of workforce transformation”

That’s according to the authors of the book Working Scared (Or Not at All): The Lost Decade, Great Recession, and Restoring the Shattered American Dream

======

The book Working Scared is focused on the ways that the American workplace has changed in the past 50 or so years … and the implications on American workers (and non-workers).

=======

The central premise of the book is that globalization (out-sourcing & off-shoring); de-industrialization (towards more services and knowledge-based); technology-intensity (computers, internet, robots); and de-unionization have shattered the American Dream for tens of millions of working adults who are struggling or poor … “despite working hard and playing by the rules.”

More specifically …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Employee engagement, Jobs - Unemployment, Working Scared | Leave a Comment »

October 22, 2016

Despair: Only adding low wage jobs … rent half of what people make.

========

Courtesy of Donna Brazile (via WikiLeaks) …

========

Couldn’t have said it better myself …

========

#HomaFiles

Follow on Twitter @KenHoma >> Latest Posts

========

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, WikiLeaks | Leave a Comment »

August 5, 2016

Here’s why many Americans feel bad about the economy.

=======

First, GDP – a measure of the overall economy – has been growing at a declining rate for the past 35 years.

The blue line below is the year-over-year percentage change of GDP … the red line is my eyeball trend line – attempting to factor out recessionary dips.

The boxes are roughly the Clinton years (green box), the Bush years (orange) and Obama years (red).

GDP growth for the past 10 years has been less than 5% year-over-year.

=========

Let’s dig a little deeper …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, GDP | Leave a Comment »

May 18, 2016

“A permanent job with good benefits is (now) beyond reach for most American workers … only federal judges and tenured professors are insulated from the forces of workforce transformation”

That’s according to the authors of the book Working Scared (Or Not at All): The Lost Decade, Great Recession, and Restoring the Shattered American Dream

======

The book Working Scared is focused on the ways that the American workplace has changed in the past 50 or so years … and the implications on American workers (and non-workers).

=======

The central premise of the book is that globalization (out-sourcing & off-shoring); de-industrialization (towards more services and knowledge-based); technology-intensity (computers, internet, robots); and de-unionization have shattered the American Dream for tens of millions of working adults who are struggling or poor … “despite working hard and playing by the rules.”

More specifically …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Employee engagement, Jobs - Unemployment, Working Scared | Leave a Comment »

October 27, 2015

In a prior post, we dissected the declining labor force participation rates in the U.S. …

Splitting the population by gender revealed some interesting differences in LFPR trends…

Note that from 1965 to about 1999, men (blue line) were steadily leaving the labor force.

But, during that period women (red line) were entering at a faster clip than the men were dropping out … so total LFPR (black line) continued to inch up.

Around 1999, women’s LFPR flattened out … but men continued to leave the workforce … so the total LFPR peaked and started to creep down.

Since 2008, both men and women have been leaving the work force, so the total LFPR has steepened its decline.

But, men are leaving at a slightly faster rate than women.

======

And, we posted the results of a study indicating that women’s LFPR in the U.S. is low relative to other countries … and declining at a time that it’s increasing in other countries.

Pundits attribute the higher LFPRs in other countries to more flexible work hours and government subsidized childcare.

Let’s look into things a bit deeper … (more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Childcare - cost of, Economics, Economy, Labor force participation rate (LFPR) | Leave a Comment »

October 26, 2015

One of the biz show pundits made an off-hand remark that he thought much of the recent decline in labor force participation rates was at least partially traceable to women dropping out of the workforce because of the high cost of childcare.

Plausible explanation that piqued my trust but verify interest, so I did a little digging.

Let’s start with the big picture : The total labor force participation rate (LFPR).

Some takeaways ….

Note that the history breaks into roughly 3 distinct eras.

From 1965 (as far back as I looked) until about 1990, the LFPR increased by about 8 percentage … almost a straight line, trending up.

Then, coincident to the 1990 recession, the LFPR essentially flat-lined with some bouncing around between 66% and 67%.

Since the 2008 financial crisis and the LFPR has dropped around 4 percentage points … not quite half of the 1965 to 1990 gain.

======

Splitting the chart by gender is where things start to get interesting.

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economics, Economy, Labor Force, Labor force participation rate (LFPR) | Leave a Comment »

April 7, 2015

Last Friday, the President was spinning the 126,000 jobs gain as a continuation of the longest consecutive period of (meager) monthly jobs gains.

OK, I added the meager part …

And, he touted how he’d added 12 million jobs to the economy since he took office.

Not to nit-pick, but it’s 10 million since he took office … 12 million since the slide bottomed out.

.

OK, so 2 million more people are working since the worst recession since the depression.

That’s pretty good, right?

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in BLS, Economy, Employment - Jobs, Unemployment | Leave a Comment »

March 9, 2015

It has been 10 days since I placed a “free shipping” order with Amazon.

Why is that important”

There are a lot of indicators bandied about to ‘prove’ how well or poorly the economy is doing.

There’s GDP, unemployment, CPI, and many, many other metrics.

Sometimes they provide a consistent view of the economy … sometimes they contradict.

Well, I’ve stumbled on the Ultimate Economic Indicator. An indisputable measure of economic activity …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Amazon, Economic indicators, Economy | 2 Comments »

February 9, 2015

A lot of chatter over the weekend about how President Obama’s economic policies are – after 6 years — humming.

More than 250,000 more people were employed … but interestingly, the unemployment rate inched up as the labor force participation rate increased a bit.

What’s going on?

A couple of economists at the NBER – the think tank that officially declares when recessions begin and end – just issued a study with an evidenced-based hypothesis …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economics, Economy, Employment - Jobs, Unemployment | Leave a Comment »

February 5, 2015

I didn’t say it, Jim Clifton, Gallup’s CEO did.

Specifically, he says that he hears all the time that “unemployment is greatly reduced, but the people aren’t feeling it.”

The reason: “The official unemployment rate, as reported by the U.S. Department of Labor, is extremely misleading.” It doesn’t capture the true angst in the job market.

The crux of his argument centers on a “good jobs” metric: the ratio of full-time workers to the total adult population.

That ratio dropped about 5 percentage points during the recession and has recouped only about one of those 5 percentage points.

That’s not good.

Clifton brings those numbers to life in his opinion piece …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Employment - Jobs, Unemployment | 2 Comments »

December 17, 2014

This isn’t it !

This one was in the WSJ last week.

The accompanying narrative was something like “adding jobs – full-time, not part-time — looking good”.

Earlier this week, we showed that the WSJ data is accurate, but it’s analysis is misleading because it starts analyzing from the depth of the recession (versus before the start of the recession) … and looks at raw numbers of jobs added (without normalizing for population growth).

Again, this isn’t the killer chart, I’m talking about.

Rather, I’ve pulled together my earlier analysis into one simple chart that tells the story …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economic indicators, Economy, Employment - Jobs, Unemployment | Leave a Comment »

December 15, 2014

It has been a while since we looked into the employment numbers … long overdue.

I was awakened by a WSJ article that put a positive spin on the November jobs report – jobs continue to be added …. and, they’re full-time jobs:

“The economy has seen a net gain of more than 6 million full-time jobs since the official end date of the 2007-09 recession, which was in June 2009. The economy has witnessed a net increase of just 311,000 part-time jobs over the same period,”

Hmmm.

Let’s dig a little deeper.

What the Journal says is true, but not complete … and picking to start the chart at the trough of the recession obscures some of the context.

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economic Recovery, Economy, Employment - Jobs, Part-time workers, Unemployment | Leave a Comment »

October 6, 2014

Lots of end-zone dancing last week re: the economy.

The President says that all indicators are good, and that folks who aren’t feelin’ it just “don’t get it” because they’re watching FoxNews too much.

Say, what?

Let’s look at the ultimate measure: household income.

Adjusted for inflation, median household income dropped 8% during the recession … and has been flat after bottoming out a couple of years ago.

That means that the median real household income is still down 8% from the pre-recession peak.

Hard to get excited about that, right?

======

The drop in median household income has come despite a steady increase in average hourly wages … they’re up about 10% since the official end of the recession.

That’s before inflation, but the Feds keep telling us that inflation is negligible, that shouldn’t matter, right?

======

Let’s see, average wages are going up, but median household income is stalled at a depressed level.

What’s going on?

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Employment - Jobs, Household income, Unemployment | Leave a Comment »

August 19, 2014

Warning: Adult Content.

The Economist – a reputable publication — recently reported the results of a groundbreaking economic analysis.

Specifically, staffers “analysed 190,000 profiles of sex workers on an international review site … with data going back to 1999 … with prices corrected for inflation.”

What did they find?

“The most striking trend our analysis reveals is a drop in the average hourly rate of a prostitute in recent years”

=====

What explains the 30% drop in prices?

Well, pardon the pun, it’s pure economics …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economics, Economy, Free - Power of Free, Pricing, Pricing analytics | Leave a Comment »

June 9, 2014

According to the Feds, the economy added 217,000 jobs in May … that’s good.

Big deal made of the fact that the economy has regained all of the jobs lost in the finance-induced recession.

But, save the high fives …that’s only part of the story.

The rest of the story doesn’t look nearly as rosy.

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in BLS, Economy, Employment - Jobs, Unemployment | Leave a Comment »

May 14, 2014

Two related articles caught my eye ….

First, Business Insider reported that “spending on healthcare grew an astounding 9.9% in Q1 … the biggest percent change in healthcare spending since 1980”

The article goes on to say: “Analysts said it’s primarily due to a consumption boost from the implementation of the Affordable Care Act.”

That makes sense.

Some folks rushed to their docs in the last quarter of 2013 to beat the jump in their deductibles and to jump the line ahead those becoming newly insured.

Nonetheless, the fact remains that, adjusted for inflation, America is spending more on healthcare than ever before..

Here’s the big takeaway … (more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economic indicators, Economy, Employment - Jobs, GDP, Health Care / Medical Insurance, ObamaCare | Leave a Comment »

May 8, 2014

Two related articles caught my eye ….

First, Business Insider reported that “spending on healthcare grew an astounding 9.9% in Q1 … the biggest percent change in healthcare spending since 1980”

The article goes on to say: “Analysts said it’s primarily due to a consumption boost from the implementation of the Affordable Care Act.”

That makes sense.

Some folks rushed to their docs in the last quarter of 2013 to beat the jump in their deductibles and to jump the line ahead those becoming newly insured.

Nonetheless, the fact remains that, adjusted for inflation, America is spending more on healthcare than ever before..

Here’s the big takeaway … (more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economic indicators, Economy, Employment - Jobs, GDP, Health Care / Medical Insurance, ObamaCare | Leave a Comment »

May 5, 2014

The headline: 288K jobs added.

Boom times in America, right?

Hmmm.

Here’s what has me scratching my head …

First, some technical background.

There are two BLS surveys: the Establishment Survey which queries businesses and the Household Survey which queries individuals, i.e. people.

The Establishment Survey is a larger sample, but has a huge data whole – new and small businesses — that gets plugged with a SWAG.

The Household Survey is smaller (about 10,000 respondents) … but big enough that it’s treated as the gold standard for calculating the unemployment rate.

It was the Establishment Survey that reported 288K jobs were added.

Guess what?

The Household Survey said the opposite … that 73K jobs were lost.

Let’s take this a step further …

Earlier last weeks, the Feds reported that GDP was essentially flat in the first quarter … only increasing by 1/10th of a percentage point.

Despite a flat economy, the BLS says that employers were adding jobs like drunken sailors.

Does that make sense to you?

My view: one of the two numbers has to be wrong … either the GDP or the employment numbers … and, given the job losses reported on the Household Survey … I’m betting the 288K job gain is more illusion than reality.

#HomaFiles

Follow on Twitter @KenHoma >> Latest Posts

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in BLS, Economy, Employment - Jobs, Unemployment | Leave a Comment »

September 12, 2013

I was a bit surprised to hear on the news that Citi was laying off a couple of thousand folks in their mortgage division.

After all, there’s been lot of talk re: housing recovery … with some markets el fuego.

Hmmm.

Turns out that mortgage applications bottomed out after the meltdown …and arguably showed some up-trend in the past couple of years (thanks to the Fed QE program),

But, mortgage apps have declined recently (as interest rates started moving up a bit) and are hovering at very low levels

What about home prices?

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Housing - Mortgages, Interest rates, Real Estate | Leave a Comment »

July 26, 2013

Interesting analysis from the Wall Street Daily …

Residential Fixed Investment — aka. “housing” — has been trending upward in 2012 …

… albeit from a low post-crisis level

… and is still far below the historical average.

Conclusion: Trend is right … with plenty of upside.

* * * * *

Follow on Twitter @KenHoma >> Latest Posts

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Housing - Mortgages | Leave a Comment »

July 24, 2013

Two related articles caught my eye …

First, the Washington Post editorialized that:

The only part of the Obama economy that has flourished is Wall Street.

Only the trickle-down from the wealthy financial players, who have thrived off the conveyor belt of money as it travels from Washington to Wall Street, has had much of a positive effect on the economy as a whole.

Let’s break down the economic fundamentals.

First, a chart showing the “conveyor belt of money” …

Note that the M1 money supply increased from about $1..4 trillion in 2009 to today’s $2.6 trillion.

Shouldn’t a cool $1.2 trillion more in supply of money get the economy cranking into overdrive?

Here’s the rest of the story …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Employment - Jobs, Stock Market, Supply of Money & Common Stock Prices, Unemployment | 1 Comment »

July 15, 2013

There are a lot of indicators bandied about to ‘prove’ how well or poorly the economy is doing.

There’s GDP, unemployment, CPI, and many, many other metrics.

Sometimes they provide a consistent view of the economy … sometimes they contradict.

Well, I’ve stumbled on the Ultimate Economic Indicator. An indisputable measure of economic activity …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Amazon, Economic indicators, Economy | Leave a Comment »

June 5, 2013

According to the Federal Reserve Bank of St. Louis’ 2012 Annual Report …

In nominal terms (i.e. ignoring inflation) aggregate household net worth at the end of 2012 was $66.1 trillion, nearly back to its precrisis peak of $67.4 trillion, reached at the end of the third quarter of 2007.

After falling to $51.4 trillion at the end of the first quarter of 2009, the subsequent increase of $14.7 trillion through the end of last year.

In other words – nominal aggregate household net worth (the blue line) is almost back to where it was before the financial crisis … call it down 3% from the peak.

,

But … there’s way more to the story.

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Net Worth | 1 Comment »

June 4, 2013

Last week, the American Legislative Exchange Council (ALEC) – a right-leaning economic analysis group – released its 6th annual report on state economic performance.

= = = = =

The 10 states that had the best economic performance over the decade 2000 to 2010 were …

Notice anything common across those states?

Here’s the code-breaker …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Tags:ALEC, Laffer, Moore

Posted in Economic indicators, Economics, Economy, Taxes | Leave a Comment »

May 10, 2013

In a couple of the past week’s posts we’ve been exploring the employment down mixing from full-time to part-time jobs.

I personally think that it is one of the most important – and least reported trends in the economy.

Flashback to last Friday … the BLS headline was that 165,000 jobs were added in April and the unemployment rate dropped to 7.5%

That news flash elicited giddy re-reporting … e.g. Business Insider’s “STOCKS GO WILD AFTER AWESOME JOBS REPORT” … “awesome” and all caps,

Yep, total employment went up 165,000 jobs … that’s true

But, here’s the rest of the story …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in BLS, Economy, Employment - Jobs, FTE - Full-time equivalent employees, Part-time workers, Unemployment | Leave a Comment »

May 1, 2013

Pew released a sobering report last week: An Uneven Recovery, 2009-2011

The central conclusion: the rich have gotten richer and the middle class has gotten crushed.

Upper and lower income groups have both increased by about 5 percentage points of the population mix.

In other words, the percentage of middle class folks – earning from 2/3s to twice the median income – has dropped by 10 percentage points.

What’s going on?

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economics, Economy, Employment - Jobs, Labor Economics, Labor Force | Leave a Comment »

April 29, 2013

In a WSJ editorial today, Vanguard CEO Bill McNabb says that …

Americans who seek to earn a living and save for the future are confused and discouraged.

Concerns of investors are asking: How does this affect my retirement fund? What about my college savings account? How does this affect my taxes? Would I be better off putting my savings under the mattress?

Firms can’t see a clear road to economic recovery ahead, so they’re not going to hire and they’re not going to spend.

It’s what economists call a “deadweight loss“.

He points to economic research that indicates U.S. economic policy uncertainty has been 50% higher in the past two years than it has been since 1985.

Source: PolicyUncertainty.com

The uncertainty revolves around regulatory policy, monetary policy, foreign policy and, most significantly, uncertainty about U.S. fiscal policy and the national debt.

Vanguard estimates that the rise in policy uncertainty has created a $261 billion cumulative drag on the economy … which adds up to more than one million jobs that we could have had by now, but don’t.

Mr. McNabb makes a strong argument.

But, I respectfully disagree.

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Gov't Waste & Inefficiency, Gov't Spending, Government & Politics | Leave a Comment »

April 25, 2013

I haven’t been a big Blodget fan since he was run off of Wall Street for hyping internet stocks during their pre-bubble bursting run-up.

I think he’s trying to balance the scales these days … leaning far left to – he hopes – increase his odds of getting through the Pealy Gates.

The essence of his article is that the only thing wrong with the economy is a lack of adequate aggregate demand.

So, the government should keep borrowing and spending … and things will right themselves,

The economic water level will rise to a point that reluctant CEOs will have no choice but to start hiring and building plants to meet demand.

That’s not a patently dumb notion … it’s just flat out wrong.

Here’s what’s wrong with Blodget’s argument …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Behavioral Economics, Economy, Jobs - Unemployment, Management - General | Leave a Comment »

March 15, 2013

Prof. Mark Perry of AEI crafted the below chart and observes …

Employment in temporary help services grew by 16,100 jobs in February, bringing the total number of temporary and contract workers to 2.58 million last month, the highest level since August 2007.

As a leading indicator of overall US labor market demand, the ongoing positive trend in temporary hiring is a sign that the labor market is gradually improving and suggests an increased pace of broader-based hiring for workers going forward in 2013.

It’s also likely that many employees who initially get hired on a temporary basis will be offered employment on a full-time permanent basis as the economy improves.

Prof Perry sees the glass as half full

Predictably, I see the glass as half-empty …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Employment - Jobs, Labor Economics, Labor Force | Leave a Comment »

March 8, 2013

Liberal economists say not to worry since interest rates are so low … take all the cheap money you can get.

So, the Feds have been piling on debt … at an average cost of about 2%.

Doing some arithmetic, the cost to service the debt is about $350 billion annually … about 10% of Federal spending.

Here’s the rub …

About half of the debt is short-term … less than 3 years.

Source: Strategic Research Partners

So what?

What if interest rates were to jump back to more historical levels …. say 6%.

Boom.

Suddenly, servicing the debt would have an annual downstroke of over $1 trillion.

Makes the Sequester look like a walk in the park, doesn’t it?

* * * * *

Follow on Twitter @KenHoma >> Latest Posts

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Debt - Deficit, Economy, Interest rates | Leave a Comment »

February 16, 2013

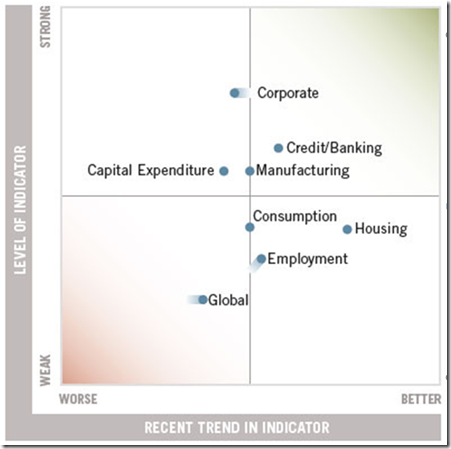

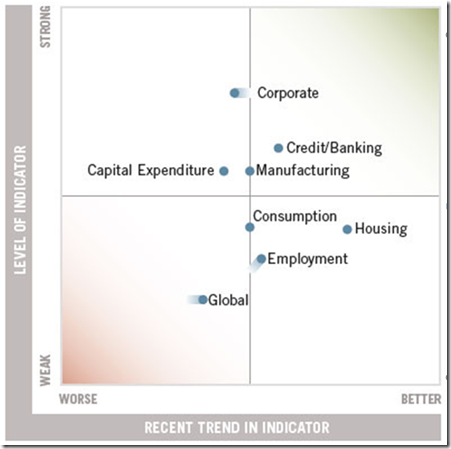

Couple of charts from Fidelity that depict the state of the economy on the head of a pin.

Well, make that two pins…

* * * * *

U.S. Economic Indicators Scorecard

On the vertical axis is the current state of the variable … good or bad.

For example, “Corporate” – think corporate earnings – is relatively high.

Employment is relatively low – think, 7.95 unemployment.

click to enlarge

On the horizontal axis is the trend of the variable – getting better or getting worse.

For example, housing is low, but the trajectory is good..

Capital expenditures are fair to midling … with a weak trend.

Overall, Fidelity’s view is fairly good.

Draw your own conclusions … for the individual variables and the gestalt.

* * * * *

Position in the Business Cycle

Another Fidelity chart depicts a typical business cycle in stages – recovery, expansion, and contraction … and plots their view of where the U.S. economy is now.

Their POV may surprise you …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Charts - Graphs - Visulaizations, Economy | Leave a Comment »

January 16, 2013

Here are a couple of charts that put things in perspective

Ask yourself: Which one doesn’t isn’t like the others?

* * * * *

Consumers have been deleveraging.

The ratio of mortgage debt to disposable income has retreated by 20 percentage points and continues to fall.

* * * * *

More broadly, the percentage of disposable income servicing household debt is at a historic low …

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Debt - Deficit, Economy, Financial leverage, Gov't Waste & Inefficiency, Gov't Spending | Leave a Comment »

January 15, 2013

Nice recap courtesy of JP Morgan Wealth Management …

Easy facts to remember:

- Feds take in about $2.5 trillion in taxes

- Deficit is just over $1.1 trillion

- Spending is over $3.6 trillion

Note that Social Security & Medicare spending is about twice what’s taken in via “Social Insurance” … aka. “payroll taxes”.

Also note how big that dashed Borrowing box is.

We don’t have a spending problem.

Yeah, right.

* * * * *

Chart Tip: Being picky, but they should have put Social Insurance at the bottom of the sources’ stack so that it lined up with Social Security and Medicare.

Every list should have a logical order … and that order is rarely the order that you thought of things.

* * * * *

Follow on Twitter @KenHoma >> Latest Posts

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Deficit, Economy, Medic, Medicare, Social Security | 1 Comment »

January 10, 2013

As loyal readers know, I’m a bear on the economy and the stock market.

That said, there are some indications that the economy’s water level is slowly rising … as evidenced in light vehicle sales (cars and small trucks) and housing starts.

Source: JP Morgan Wealth Management

* * * * *

So, why my pessimism?

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy | 1 Comment »

January 4, 2013

This chart can’t be shown too often

Remember when Obama’s crack team of economic advisers said “Give us a trillion dollars and we’ll keep unemployment under 8%”?

They also said that the unemployment rate would be about 5.2% right about now.

Well, we’re at 7.8% … a mere 50% miss.

Wish I’d been held to those accountability standards when I was working in corporate America.

Source: AEI

* * * * *

Follow on Twitter @KenHoma >> Latest Posts

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economic Recovery, Economy, Obama - Promises Made & Kept | 2 Comments »

December 11, 2012

Conventional wisdom: increasing proportion of old folks will be a drag on the consumer economy.

People in their 50s spend more than younger – or older folks … by a lot.

The economic implications are monumental.

Here’s the logic from Bill Gross at PIMCO:

(more…)

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Consumption, Economy, Mktg - Consumer Behavior | Leave a Comment »

December 7, 2012

The “Establishment Survey” provided the “headline number” that 146,000 jobs were added … from 133,706,000 employed in Oct. to 133,852,000 Nov.

* * * * *

And, the unemployment rate dropped from 7.9% to 7.7%.

* * * * *

But, the population of working age adults increased by 191,000 – more than the number of added jobs … from 243,983,000 in Oct. to 244,174,000 in Nov.

That should increase the unemployment rate, right?

* * * * *

More important, the “Household Survey” – the basis of the unemployment rate calculation — reported that 122,000 jobs were LOST… from 143,384,000 employed in Oct. to 143,262,000 Nov.

For sure, that should increase the unemployment rate, right?

* * * * *

But the unemployment rate didn’t go up, it went down … because the civilian labor force CONTRACTED by 350,000 … from 155,641,000 in Oct. to 155,291,000 Nov.

That is, 350,000 people stopped looking for work and were no longer counted as unemployed..

* * * * *

Said differently, the labor force participation rate dropped … and is now about 2.2 percentage points lower than it was when Obama took office

* * * * *

And, consumer confidence dipped, so don’t be surprised if even more people stop looking for jobs.

* * * * *

Bottom line: Not your classic turnaround … but if enough people stop looking for jobs, we’ll have this unemployment mess fixed in no time.

Ouch !

* * * * *

Follow on Twitter @KenHoma >> Latest Posts

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in BLS, Economy, Employment - Jobs, Unemployment | Leave a Comment »

December 6, 2012

First, glance at what’s been going on with government employment the past couple of months

… about 1 million employees were added to government payrolls from June 2012 until election day.

Hmmm.

* * * * *

Now, take a gander at Gallup’s daily tracking of unemployment.

Note that Gallup’s unemployment rate dropped by about a point in the run-up to the election.

Virtually all of that drop is attributable to the bump in government employees.

Double hmmm.

And, Gallup’s unemployment rate is up about 3/4’s of a percentage point since the election.

Triple hmmm.

I thought that Team Obama had this economy turned around …

Oops.

* * * * *

Question: Tell me again how higher tax rates will help a faltering economy?

Unless the BLS fudges the number tomorrow, the GOP may finally have an arrow in their fiscal cliff quiver.

* * * * *

Follow on Twitter @KenHoma >> Latest Posts

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in BLS, Economy, Employment - Jobs, Unemployment | 1 Comment »

December 3, 2012

Here’s a chart to calibrate your perspective …

The Fed Funds Rate currently running at about zero … that compares to a historical average of about 8% … and a peak of about 18% in the Carter years.

There’s only one way to go – up.

Imagine the fiscal crisis if if the interest rate on the $16 Trillion debt slides back up to the 8% historical average … or, gawd forbid, to the Carter-level rates.

Now, that would be a fiscal cliff !

Source

* * * * *

Follow on Twitter @KenHoma

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Fiscal cliff, Interest rates | Leave a Comment »

December 2, 2012

Most press reports have said the Black Friday was boomville.

Really?

Not according to Gallup which reported that “self-reported spending” during the Black Friday weekend was down almost 20% from last year … from $103 to $84.

Hmmm.

* * * * *

Follow on Twitter @KenHoma >> Latest Posts

SHARE THIS POST WITH FRIENDS & FAMILY

Posted in Economy, Retailing | Leave a Comment »